Australian wine exports continue to set records, with a new high for the average value of bottled wine exports of $5.74 per litre and exports to China (including Hong Kong and Macau) increasing by 51% for the year to March 2018 to reach $1.04 billion – a first for exports to a single country – according to data released by Wine Australia today.

Wine Australia chief executive officer, Andreas Clark, said the 12 months to March saw exports increase by 16% in value to reach $2.65 billion – the highest value in a decade – and volume also increased by ten per cent to a near-record level of 844 million litres or 94 million nine litre case equivalents.

Assistant minister for agriculture and water resources, Anne Ruston, said the export numbers are a win for the wine industry and a win for jobs in regional Australia.

“Regional Australia continues to benefit from higher exports − we’re not going to get rich selling to ourselves,” Ruston said.

“It makes sense that we export our wine when the world’s largest market is right on our doorstep.

“These record wine export numbers also have benefits far beyond the cellar door, with important flow-on effects for the towns and cities around our wine regions.”

Clark said as value growth outpaced volume growth, the average value per litre of all Australian wine exported increased by five per cent to $3.14 per litre.

The value of bottled wine exports increased by 15% to $2.15 billion, the highest value since 2009.

The average value of bulk wine also increased, by eight per cent to $1.05 per litre, the highest value since 2009.

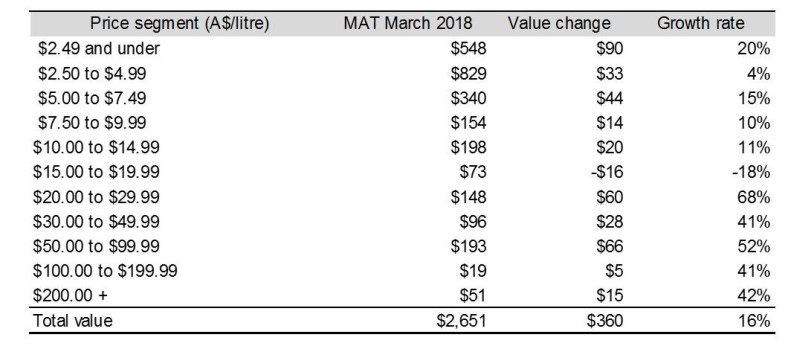

Higher value wine exports grew substantially with exports of wine above $10 per litre reaching a new peak of $779 million for the year to March 2018.

Figure 1: Exports by price point (million AUD *FOB)

Clark said the high quality of Australian wine, plus historically low Northern Hemisphere harvests were driving the demand for Australian wine exported in bulk containers, leading to growth in both volume, which grew by ten per cent to 462 million litres, and the total value of exported bulk wine, which grew by 19% to $486 million.

“Every country in Australia’s top 10 bulk wine destinations recorded an increase in average value, especially Germany, the largest importer of wine in the world, where average values for bulk wine increased by 20 per cent from $0.87 to $1.05 per litre,” he said.

Clark explained that wine exports to China had grown as wine tariffs had dropped again in January 2018, in line with the China–Australia Free Trade Agreement.

The tariff would be removed completely in January 2019, providing Australian wine exporters with a competitive advantage over key producers such as France, Italy and Spain.

“Mainland China has now overtaken the USA to become Australia’s second largest export market by volume.

“Pleasingly there was very strong growth at all price points as imported wine becomes more approachable and is increasingly consumed by middle-class drinkers and seen as suitable for consumption at informal gatherings and while relaxing at home,” Clark said.

He added that while the commercial end of the USA market was in decline, contributing to the drop in volume, there had been strong growth in the premium sectors.

“Wine Australia is already reaching out to producers to remind them that now is the time to set their vineyards up for an outstanding 2019 vintage”

For wines $10 per litre and over, the strongest contribution came from the $30–49.99 segment, which increased in value by 25 per cent to $5 million.

According to IRI Worldwide, in 2017 Australian sales in the USA off-trade market declined by one per cent in value but there was strong growth in two price segments.

At US$8–11.99 per bottle, Australian sales doubled while at US$20–24.99 per bottle grew by 22%.

Exports to the United Kingdom (UK), Australia’s largest export destination by volume, increased in value by nine per cent to $373 million and in volume by eight per cent to 241 million litres.

Average value increased slightly by one per cent to $1.55 per litre.

In the UK off-trade retail market Australian sales increased by two per cent in value in 2017, maintaining the nation’s long-held number one position in the UK retail market according to market data analysts, Nielsen.

On the domestic front, Australian wine sales in the off-trade retail market increased by three per cent in value to $3.5 billion in the 12 months ended 4 March 2018, with the strongest growth occurring in the $15–30 per bottle segment, according to IRI MarketEdge.

Clark said excellent vintage conditions in Australia would sustain the sector’s growth as the relatively cool, dry summer had produced high-quality grapes and winemakers are excited about the exceptional quality of the 2018 vintage wines.

“Wine Australia is already reaching out to producers to remind them that now is the time to set their vineyards up for an outstanding 2019 vintage.”