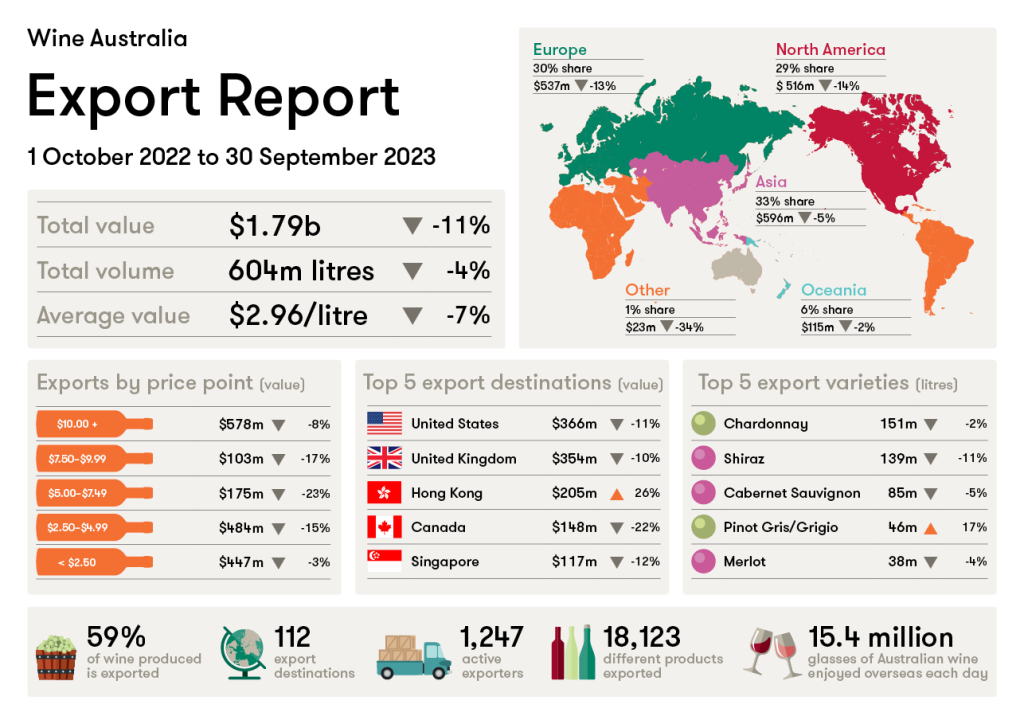

Australian wine exports declined by 11 per cent in value to $1.79 billion and 4 per cent in volume to 604 million litres in the year ended September 2023, according to Wine Australia’s latest Export Report released today.

This export performance is well below long term averages, driven by a global decline in wine consumption across many mature markets, especially in commercial wines (less than US$10 per bottle) where most Australian export volumes are sold.

Cost of living pressures are also slowing down the longer-term global premiumisation trend, as some consumers are moderating alcohol consumption as a cost-saving strategy.

The United Kingdom and Canada were big contributors to the decline in volume in the latest quarter. This performance reflects the broad economic challenges for wine sales in the UK, such as inflation and increasing taxes and duties on alcohol. Likewise, heightened levels of unpackaged shipments to Canada in recent times are showing signs of stabilising, while packaged volumes continued their decline.

Wine Australia manager, market insights, Peter Bailey, said that total export value has been on a downward trajectory since peaking at $3.1 billion in the 12 months ended October 2020.

“Over the past 12 months, the United States of America was a major contributor to the overall drop in value, along with Canada, and the UK. Growth to Hong Kong offset some of this decline.

“However, despite this decline over the past year, there were some positive signs in the US this past quarter, with exports growing by 8 per cent in value in comparison to the same quarter in 2022,” Bailey said.

The number of Australian wine exporters also increased to 1,247 in the year ended September 2023, with 98 more companies exporting than the previous year. The market that experienced the highest growth in the number of exporters among the top markets was Hong Kong, followed by Thailand and Vietnam.

There were mixed results across the Asian region, including a decline in exports to Singapore and an increase in exports to Hong Kong, two key trading hubs in the region, reflecting volatile market conditions at present. Key emerging markets such as Thailand and Philippines grew in value during this period.

The announcement that China has agreed to undertake an expedited review of its import duties on Australian wine is obviously a welcome step for grapegrowers and winemakers across the country. Wine Australia says it will continue to work closely with the Australian Government and Australian Grape & Wine to support this process in any way it can.

The top five markets by value in the year ending September 2023 were:

- US (down 11 per cent to $366 million. 20 per cent share of total export value)

- UK (down 10 per cent to $354 million. 20 per cent share of total export value)

- Hong Kong (up 26 per cent to $205 million. 11 per cent share of total export value)

- Canada (down 22 per cent to $148 million. 8 per cent share of total export value), and

- Singapore (down 12 per cent to $117 million. 7 per cent share of total export value).

The top five markets by volume were:

- UK (down 3 per cent to 215 million litres. 36 per cent share of total export volume)

- US (down 4 per cent to 134 million litres. 22 per cent share of total export volume)

- Canada (up 20 per cent to 74 million litres. 12 per cent share of total export volume)

- New Zealand (down 3 per cent to 31 million litres. 5 per cent share of total export volume), and

- Germany (down 9 per cent to 28 million litres. 5 per cent share of total export volume).

Market insights for business decision-making

Wine Australia is continuing to provide market data where possible for growers, wineries and exporters to make informed decisions on where they are best placed to succeed. Businesses can visit our Interactive Insights platform to access tools such as the Grape Price Indicators dashboard and Market Explorer, or to book a session with its Market Insights team.

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!