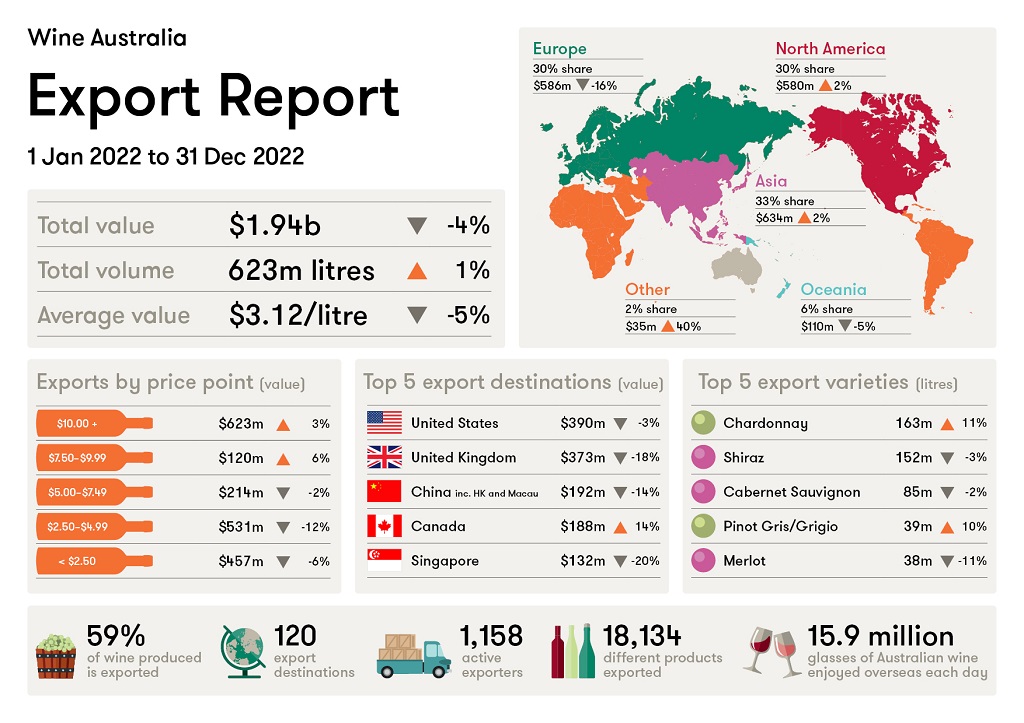

Australian wine exports increased by 1 per cent in volume to 623 million litres and declined by four per cent in value to $1.94 billion in the year ended 31 December 2022, according to Wine Australia’s latest Export Report released today.

The rise in volume relative to value was driven by growth in the shipments of unpackaged wine, particularly to the United States of America (US) and Canada, as global shipping challenges improve.

Diversification and intensification efforts of Australian wine exporters were also evident in the report, with exporters shipping wine to 120 destinations during the period, up from 112 the previous year and the highest since the start of the COVID-19 pandemic.

Growth in the value of exports to Southeast Asia continued through the period with a 16 per cent rise in value to $305 million.

Notwithstanding, it was another tough year for Australian wine exporters, with rising inflation, business costs and interest rates impacting margins, and it is anticipated this will continue in 2023.

Wine Australia manager, market insights Peter Bailey said the increase in unpackaged wine exports is an indication of improvements to the significant shipping challenges in some markets, which have been a factor since 2021.

“It was pleasing to see positive signs of improvements emerging in shipping conditions in some markets, noting delays are still being reported along certain trade routes,” Bailey said.

“Shipments of 2021 and 2022 vintage wines had been largely delayed due to the shipping challenges, particularly unpackaged shipments. As these conditions eased in the latter half of 2022 in some regions, Australian wine producers were finally able to ship their products to customers overseas.

“This increase in the share of unpackaged wine shipments contributed to the decline in the total value of exports, as unpackaged wine is shipped at a lower average free-on-board value because packaging costs are excluded.

“Increases in the value of exports to Thailand, Malaysia, and Canada offset declines in value to Singapore, Hong Kong, and the US. However, decreased shipments to the United Kingdom (UK) in the second half of 2022, were greater than the increase in overall value to other markets.

“This drop was anticipated, as Australia experienced two years of elevated shipments as a result of Brexit deadlines and increased demand for wine in the off-trade (supermarkets and bottle shops) during the COVID-19 pandemic when many on-trade businesses were closed.”

The decline in the overall value of exports was driven by shipments valued below $5 per litre free-on-board (FOB), which declined by nine per cent to $988 million. Exports in this segment declined in value in a number of markets – including the UK, US, Denmark, Germany, the Netherlands, and New Zealand.

Meanwhile, exports above $5 per litre increased by two per cent in value to $957 million. The markets driving this trend were Thailand, Malaysia, Canada, Denmark, and Japan. Growth to these markets has been partially offset by a decline in exports in this price segment to Singapore, Hong Kong, and the UK.

“Contributing most to the growth above $5 per litre were exports valued above $10 per litre, which grew by 3 per cent in value to $623 million. This price segment increased its share of packaged exports in many destinations, which aligns with premiumisation trends in mature markets of wine consumers drinking less, but higher priced, wine,” Mr Bailey said.

The top five markets by value were:

- US (down three per cent to $390 million. 20 per cent value share of total export value)

- UK (down 18 per cent to $373 million. 19 per cent share of total export value)

- Canada (up 14 per cent to $188 million. 10 per cent share of total export value)

- Hong Kong (down 13 per cent to $167 million. 9 per cent share of total export value), and

- Singapore (down 20 per cent to $132 million. 7 per cent share of total export value).

The top five markets by volume were:

- UK (down 11 per cent to 216 million litres. 35 per cent share of total export volume)

- US (up 13 per cent to 140 million litres. 23 per cent share of total export volume)

- Canada (up 46 per cent to 68 million litres. 11 per cent share of total export volume)

- Germany (down 15 per cent to 29 million litres. 5 per cent share of total export volume), and

- New Zealand (down six per cent to 29 million litres. 5 per cent share of total export volume).

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!