As many in the hospitality and tourism industry continue to play the drab hand that the COVID-19 pandemic has dealt them, the consumers not directly impacted by the virus tell a different story.

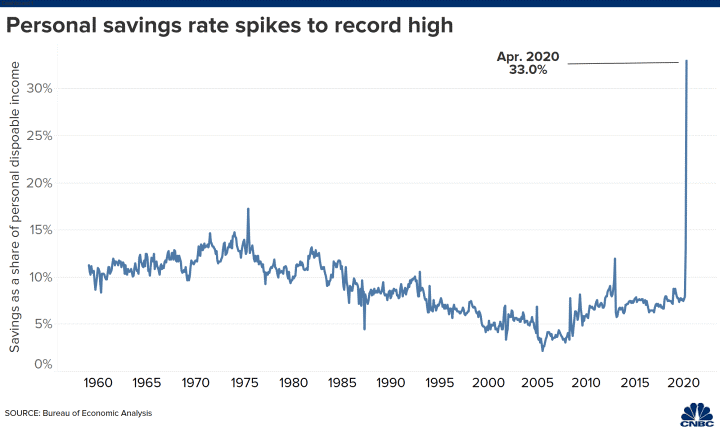

In Australia, the US and many developed markets, the middle class is reportedly sitting on a pile of cash due to household income savings being at an all-time high.

The biggest transference of money from the public sector to the private in history has been happening with governments pouring billions of dollars into propping up people’s incomes.

And if people were lucky enough to have bought into the stock market anywhere near the bottom, they’ve made a bomb.

The question remains, now that travel presents limited opportunities interstate and internationally, with only intrastate travel being the only viable option for many states, with the exception of Victoria, what are these people to spend on now?

Luxury goods, including wine, are booming. In the US, it’s shown in the numbers for DtC (direct to consumer) sales, in online retail and even in Nielsen-monitored retail.

It’s been reported that bottles between USD$20-100 have been flying off shelves.

Wine Business Solutions’ ‘Wine On-Premise USA 2020’ has just been released. One of its key findings is the way in which the two-speed economy has only accelerated.

“Of the top 30 most listed importers and primary suppliers, The Wine Group is the cheapest, in terms of the average listed price of its brands, and they are the fastest growing (besides those businesses that undertook major acquisitions during the last 12 months). No real surprises there,” said Peter McAtamney, Wine Business Solutions principal.

McAtamney says at the other end of the scale, Möet Hennessy, for example, grew its listings by 9% during the 12 months to July 2020 but grew its average listed price by nearly a third as listings of Dom Perignon have boomed.

“It doesn’t matter whether it is brands, country categories or regions, those in the bottom quartile, in terms of average listed price, have had to cut prices to sell to a consumer with less money and even less certainty,” he said.

“Those in the top half of any category have been able to lift prices relatively easily and significantly.

“So, it really is the best of times and the worst of times. Those who have not evolved and who are priced at the bottom of the market will be coming under immense pressure, unless they have the huge scale of the likes of The Wine Group, Gallo and Constellation. Those businesses that have been actively engaging in a premiumisation strategy are reaping the rewards now.

“Australia may not have grown its share of listings during the year but the average price of a bottle of wine on a wine list increased by over 20%. Only France and Portugal now have higher prices. The hard work and investment put into this market last year to lift the image of Australian wine seems to be having effect.”

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!