Source: GlobalData Consumer Intelligence Centre, Market Analyser

Even as the COVID-19-induced cocooning behaviour and fiscal prudence continue to spur at-home consumption of wine in Japan, on-premise demand for wine is witnessing a rebound as foodservice and tourism venues resume normal operations, and more cultural and sports events, weddings, and parties are organised.

Against this background, the Japanese wine market will grow from JPY760.7 billion (US$6.9 billion) in 2021 to JPY990.5 billion (US$10.2 billion) by 2026, registering a CAGR of 5.4 per cent, forecasts GlobalData, a leading data and analytics company.

GlobalData’s latest report, Japan Wine – Market Assessment and Forecasts to 2026, reveals that the market growth will be primarily driven by the fortified wine category, which is set to register the fastest value CAGR of 7.1% over 2021-2026.

The category will be followed by still wine with 5.5% CAGR and sparkling wine with 4.9% CAGR over the forecast period.

“As on-premise consumption contributes to a large chunk of wine sales, the reopening of restaurants, bars, pubs (izakayas), and clubs is bolstering the overall wine sales,” Bobby Verghese, consumer analyst at GlobalData, said.

“Elderly individuals with high purchasing power are the powerhouses of the Japanese wine market. Young consumers are also more inclined to have wine as an alternative to spirits and beer during socialising occasions, business meetings, mealtimes, and parties. Fine dining restaurants offer guests sommeliers’ service to pair wines with the menu.”

Food and drinks specialists were the leading distribution channel in the Japanese wine market in 2021. This is partly due to wine shoppers’ preference to visit stores where skilled staff can provide cues about wine varieties and styles.

Hypermarkets and supermarkets, and convenience stores were the other leading channels.

“The heightened health consciousness due to COVID-19 is stimulating demand for red wine, which is scientifically proven to be beneficial for health, as well as natural, certified organic, and biodynamic wines,” Verghese continued.

“Unlike the conservative Gen X generation, Millennials and Gen Y consumers are experimenting with new varieties of wine. With these young consumers foregoing the drinking culture of their predecessors, low-alcohol wines are set to gain more traction in the coming years.”

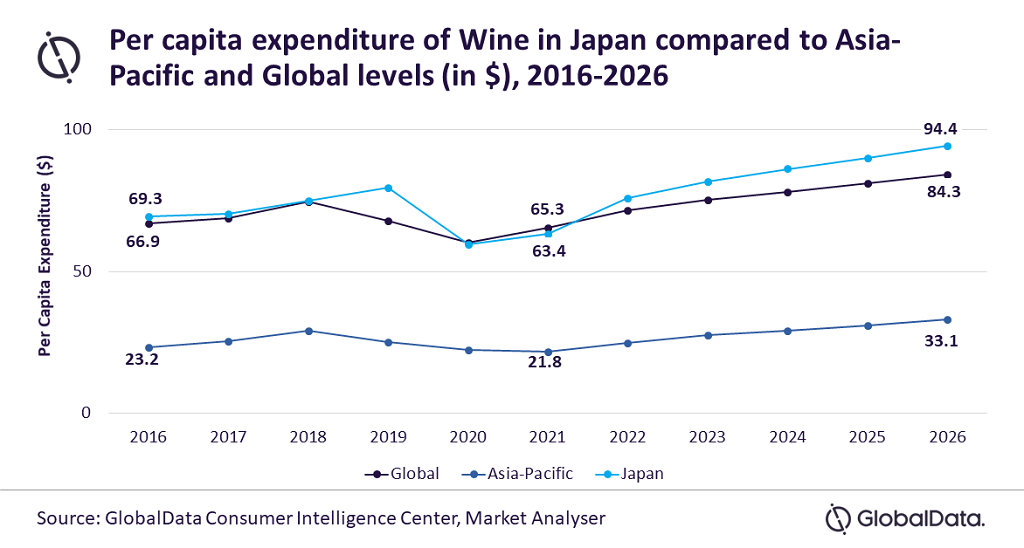

The per capita expenditure (PCE) on wine in Japan decreased from US$69.3 in 2016 to US$63.4 in 2021. While the Japanese PCE on wine surpassed the regional level of US$21.8, it fell below the global average of US$65.3. The PCE on wine will surge to US$94.4 in 2026.

Mercian Corporation, Suntory Holdings, and E. & J. Gallo Winery were the top three companies in the Japanese wine market in volume terms in 2021, while Mercian, Carlo Rossi, and Frontera were the leading brands.

“Currently, a divergence in consumption behaviour is visible, with demand simultaneously on the rise for both premium Champagne and Burgundy wines, and affordable sparkling wines,” Verghese concluded.

“Moreover, single-serve cups and glasses, canned RTD wines, and half and quarter wine bottles are gaining popularity in line with the increase in single-person households. This consumer value- volume trade-off, and the revival in tourism activities will spur premiumisation in the Japanese wine market in the coming years.”

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!