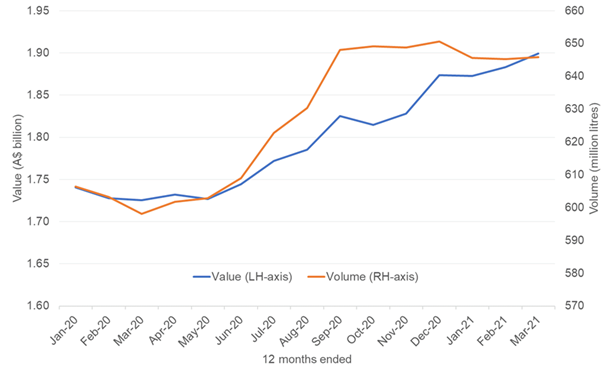

Australian wine exports declined by four percent in value to $2.77 billion in the 12 months to March 2021, compared with the previous corresponding period, driven principally by the toll taken by high Chinese tariffs, according to Wine Australia’s latest Export Report.

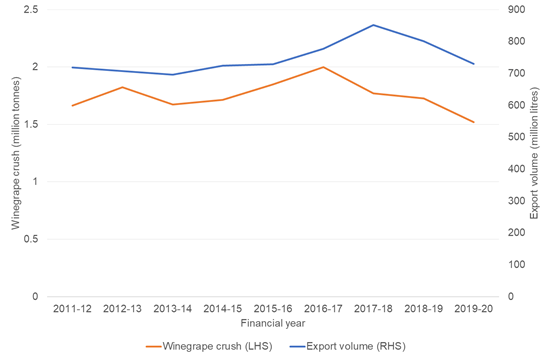

Export volume declined by 1% to 724 million litres (80 million 9 litre case equivalents) while the average price per litre for wine exports declined by 3% to $3.82 free on board (FOB).

Wine Australia CEO Andreas Clark said the decline in exports was due principally to a steep decline in exports to mainland China as well as the cumulative effects of three consecutive lower vintage in Australia leading to less volume available to export.

“Notwithstanding the impact of China’s tariffs, we were still looking at a potential downturn in exports over this period simply due to the supply situation,” Clark said.

Clark said exports to China for the December 2020 to March 2021 period were just $12 million compared to $325 million in the comparable period a year ago.

“As the tariffs apply to product in bottles under 2 litres, the decline in exports to China was mainly in bottled exports,” he said.

“This, along with increased unpackaged shipments to other markets such as the UK, resulted in a drop in the share of bottled exports in the export mix, from 46% of total volume in the 12 months ended March 2020 to 41% in the same period in 2021. This led to the decline in the overall average value of exports.”

Clark said on a more positive note there had been significant growth in exports to Europe (including the UK), which was up 23% to $710 million, the highest value in a decade.

“There was also growth to North America, up 5% to $628 million, and Oceania, up 7% to $112 million,” he said.

Clark said if exports to mainland China were excluded for the past 12 months there had been positive growth in export value with a 10% growth to $1.9 billion and 8% in volume to 646 million litres (71.8 million cases).

Destinations

The top five markets by value were:

- Mainland China, down 24% to $869 million

- United Kingdom (UK), up 33% to $461 million

- United States of America (USA), up 4% to $432 million

- Canada, up 9% to $195 million, and

- Hong Kong, up 55% to $148 million.

The top five destinations by volume were:

- UK, up 21% to 264 million litres

- USA, down 1% to 135 million litres

- Mainland China, down 40% to 78 million litres

- Canada, up 4% to 54 million litres, and

- Germany, up 22% to 36 million litres.

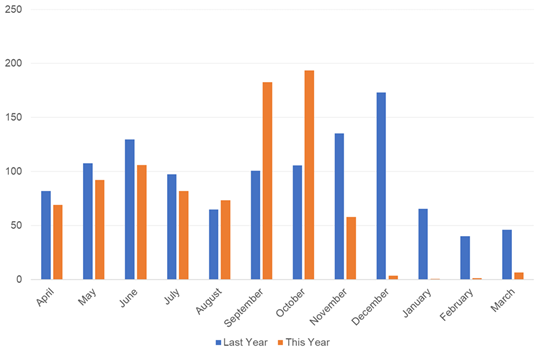

United Kingdom

The recent strong growth in exports to the UK continued in the 12 months ended March 2021. Value increased by 33% to $461 million and volume by 21% to 264 million litres (29.3 million 9-litre case equivalents).

This extended the UK’s lead as the biggest destination for Australian wine exports by volume and saw it jump over the USA into second place by value. The average value received for Australian wine in the UK increased by 10% to $1.75 per litre, the highest level in a decade.

United States of America

Despite a volume decline of 1%, the value of exports to the USA increased by 4% in the 12 months ended March 2021 to $432 million. The average value increased by 5% to $3.21 per litre.

The main driver of growth was between $2.50 and $4.99 per litre. Within this segment, the growth was relatively evenly split between red and white still wine, with red up 10% to $145 million and white up 11% to $136 million.

There was also very strong growth at $20.00–$29.99 per litre. More than 90% of shipments in this segment were red wine and have doubled in the past five years.

Container type

In the past 12 months, the value of wine exported in glass bottles decreased by 8% to $2.2 billion while volume decreased by 10% to 299 million litres (33 million 9-litre case equivalents). This translated to a 2% increase in the average value of bottled exports to $7.26 per litre FOB.

Unpackaged wine exports increased by 18% in value to $577 million and increased 8% in volume to 418 million litres (46 million 9-litre case equivalents). The average price of unpackaged wine increased by 9% to $1.38 per litre FOB.

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!