Image courtesy Wine Australia

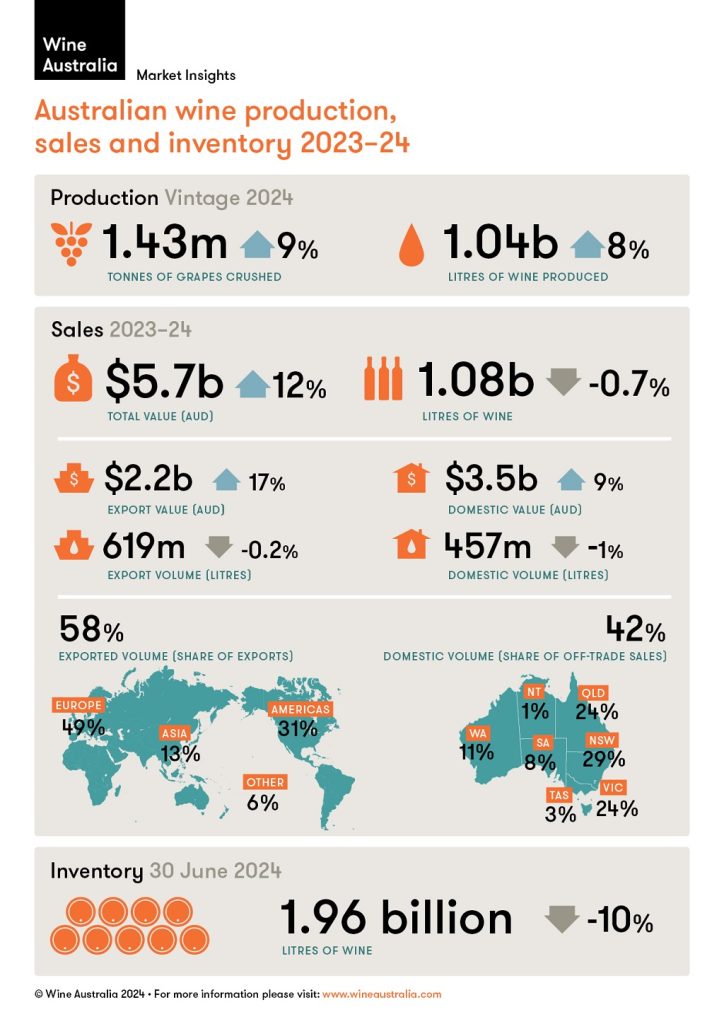

The Australian Wine Production, Sales and Inventory Report 2024 was released yesterday by Wine Australia, providing the finer details of the balance between Australia’s wine production and sales, and highlighting that the nation’s small vintage had contributed to a 10 per cent reduction in inventory as of the end of the 2024 financial year.

In 2023-24, wine production reached just over one billion litres (equivalent to 116 million 9-litre cases)—an 8% increase compared with 2022–23, making it the second-smallest production reported in 17 years, and 16% below the 10-year average of 1.24 billion litres.

Peter Bailey, manager of market insights at Wine Australia, said that the below-average production from the 2024 vintage was due to a combination of seasonal factors and economic and market conditions.

“This was another difficult season in many regions, with heavy rainfall and flooding, widespread windy conditions affecting flowering, and dry spring weather leading to cold nights and the potential for frost damage,” explained Bailey.

“However, the result has also stemmed from deliberate decisions by grapegrowers and wine businesses to reduce production or intake, driven by the current economic and market conditions affecting demand for wine.”

The overall increase of 8% compared with 2022–23 was made up of a 20% increase in white wine production, partly offset by a 2% decrease in red wine production. This saw white wine’s share of production increase from 46% to 51%—the first time in 12 years that the production of white wine has exceeded that of red wine in Australia.

Bailey said that this change reflected adjustments made by the sector to counter the oversupply of red wine.

Consecutive small vintages contribute to stock reduction

The smaller production levels meant that sales exceeded production, which contributed to a 10% reduction in inventory as of 30 June 2024, and a corresponding decrease in the stock-to-sales ratio (SSR), which fell by 14% to 1.82. The SSR for white wine fell to below its 10-year average, while the SSR for reds remained 15% above its 10-year average despite falling by 23% over the past two years (see Figure 1).

Figure 1: Stock-to-sales ratio (SSR) for Australian wine by colour over time

Bailey noted that the latest data shows stocks moving in the right direction, but said this was due to the small vintages, rather than growth in sales.

“The survey results indicate that stock-to-sales ratios have reduced, and production and sales are closely aligned. However, that is based on the current production levels, which are well below the long-term average.

“Any increase in production is likely to result in stock levels rising again, unless there is a corresponding increase in sales. This is a particular concern for reds, where the stock-to-sales ratio is still well above the long-term average,” he said.

Sales volume declines despite China market reopening

The total volume of sales of Australian wine in export and domestic markets was 1.08 billion litres (120 million 9-litre cases). This was a decrease of 1% compared with 2022–23, with both domestic and export sales showing very small declines.

Although more white wine was produced in the ’24 vintage than red, white wine sales were overshadowed by red sales in the financial year 2023-24, due to the 4% growth in red wine exports.

Contrary to the change in share of production, white’s share of total sales declined due to 4% growth in red wine exports, which Baily noted was due to the resumption of red wine exports to China.

The volume of exports to China grew from one million litres to 32 million litres (5% of total wine exports) in the 2023–24 financial year, almost all of which (96%) was red table wine. Bailey cautioned that this was likely to represent the re-stocking of Australian wine in the market after a long absence, and did not necessarily equate to retail sales.

“It will take some time before there is a clearer picture of how Chinese consumers are responding to the increased availability of Australian wine in–market.”

The Australian Wine Production, Sales and Inventory Report 2024 can be downloaded here.

Updated price indicators for inland winegrape growers

The Grape Price Indicators dashboard, developed by Wine Australia with funding from the Australian Government through its Improving Market Transparency in Perishable Agricultural Goods Industries program, has been updated today with the latest figures from the Australian Wine Production, Sales and Inventory Report 2024, as well as global figures from the OIV World Wine Production Outlook November 2024 and the Ciatti Global Market report for November.

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!