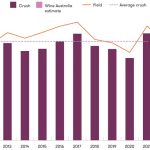

Winegrape crops in Europe all appear to be down in size on last year’s bumper hauls, including in France, Spain and Italy, according to the latest Global Market Report by Ciatti Global Wine & Grape Brokers.

The September-dated report says the harvests in France, Spain and Italy appear to be down by 4%, 15-20% and 16%, respectively, compared with the 2018 vintage.

In introducing the report, Ciatti’s Robert Selby said the potential shortfalls in Europe this year compared last year had come as no surprise.

“It has been a difficult growing season across Europe, with highly variable conditions – from severe frosts to record-breaking heat sparking bushfires to potential fungal disease,” Selby notes.

“That said, disease pressure appears to have been well-contained and there is confidence that the 2019 vintage will – on the whole – be a good one quality-wise, especially on the reds which have benefited from smaller berries yielding deep colour.”

He said buyers of international varietal wines out of Spain – where supply of these wines makes up only a fraction of each vintage – were encouraged to secure their needs sooner rather than later.

“On Spanish generics however, prices are unlikely to rise significantly as there is an awareness that Argentina is offering incredibly aggressive pricing on generics at the moment,” Selby added.

“Argentina is also highly competitive on all other wines, including Malbec and the international varietals. Prices are open to negotiation, but the country’s mounting inflation (55%) and interest rates (85%+) mean sellers there are likely to be reluctant to further price-cut despite the large inventory – now estimated at 600 million litres.”

He said the current weakness in the peso in both Argentina and Chile was helping those countries to look even more attractive to international buyers.

“Both countries are emerging from drier than normal winters; there are real concerns in Chile regarding water reserve levels going into the 2019-20 growing season – the Valle Central has endured its second driest winter since 1950,” Selby said.

Referring to Australia, Selby notes the cost of irrigation in the Murray-Darling Basin has risen by 140% in the past 12 months, adding the ongoing dry conditions in the Southern Hemisphere were something for buyers to keep an eye on, “especially if Europe’s shortfalls come in larger than anticipated”.

“The global bulk wine supply feels balanced to slightly long at present, especially when California is taken into account, but – as everyone in this industry will know – things can soon change,” Selby cautioned.

He said California’s slow bulk wine market and significant inventory had seen Central Valley – and even some Coastal – wine prices fall back into international competitiveness.

“Expectations of a third-consecutive healthy-sized crop means that the opportunities now available are unlikely to be short-term, and suppliers are seeking to build relationships,” he said.