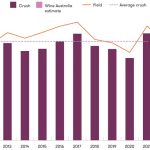

The Australian winegrape crush in 2020 was 1.52 million tonnes – the equivalent of over 1 billion litres of wine, according to the National Vintage Report 2020 released today by Wine Australia.

The 2020 crush was 12 percent lower than the 2019 crush, and 13% below the ten-year average of 1.75 million tonnes.

It was the smallest crop since 2007 but was most similar in terms of yield to 2010 – a year of exceptional wines – when the crush was 1.61 million tonnes, but the vineyard area then was about 4% higher than the current area.

Wine Australia chief executive officer Andreas Clark said while the crop was down, wine quality was expected to be high.

He added that autumn temperatures were generally around average or slightly cooler, leading to ideal ripening and harvesting conditions, and the reduced yields have resulted in more concentrated colours and flavours in the berries.

“This vintage will enable us to continue to meet our targets of value growth in premium wine market segments, although the constrained supply will restrict overall volume growth in the next 12 to 24 months,” he said.

Continuing strong demand for Australian wine is reflected in the 5% increase in the average value of grapes, which has increased by a compound average of 5% per year for the past six years.

The total value of the winegrape crush is estimated to be $1.07 billion, with an average value of $694 per tonne compared with $663 in 2019.

A smaller crop was widely anticipated given a number of seasonal factors. However, the diversity of winegrowing regions and the ability of Australian grapegrowers to manage seasonal variations and weather events moderated the impact on the vintage.

The three large inland regions: Riverland (South Australia), Murray Darling–Swan Hill (Victoria/New South Wales) and Riverina (New South Wales), which make up around three-quarters of the crush, were less affected than other regions due primarily to the availability of supplementary water.

Together, these regions were down by 4% compared with 2019, while the remaining regions were down collectively by 34%, with a wide range of individual variation.

Clark said that the wine sector had made significant investments in research and development, leading to improved vineyard management techniques and water use efficiency since the last drought.

Clark said crop losses due to fire and/or smoke damage were reported in around one-quarter of Australia’s winegrowing regions; however, the overall reduction due to direct damage or smoke effects was estimated to be less than 40,000 tonnes, or 3% of the total crush.

Red varieties fared slightly better than white varieties in 2020, being down by 11% compared with 2019, while white varieties were down by 13%.

Australia’s largest variety, Shiraz, decreased by 10% to 376,000 tonnes and increased its share of the total crush to 25%.

Other red varieties to do relatively well were Durif and Ruby Cabernet (up by 9% and 8% respectively) while the biggest declines were for Pinot Noir (down 24%) and Merlot (down 20%).

The main contributor to the reduction in the white crush was Chardonnay, which was down 19% to 285,000 tonnes, while Riesling had the biggest decrease in percentage terms, down 28% to a 20-year low of just under 17,000 tonnes.

Prosecco increased slightly, against the general trend, and moved up to ninth place in the top 10 white varieties.

“The increase in average value for Shiraz is far outpacing that for Chardonnay, leading to strong demand signals favouring Shiraz,” Clark said.

“This is reflected in our exports. The average value of bottled Shiraz exports was $9.21 per litre FOB in 2019 compared with $4.29 for Chardonnay.”

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!