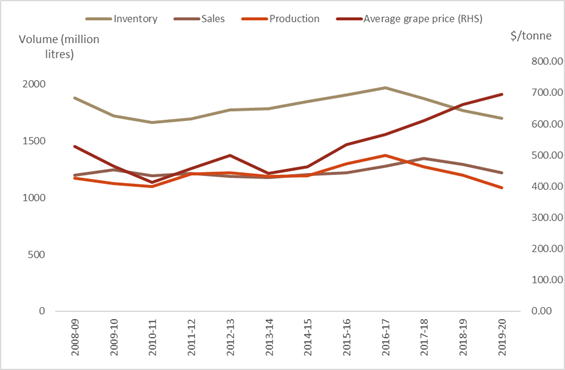

Australian wine sales during 2019–20 exceeded supply for the third year in a row, leading to the lowest stock-to-sales ratio in 9 years and strengthening winegrape prices, according to Wine Australia’s Wine Production, Sales and Inventory Report 2020 released today.

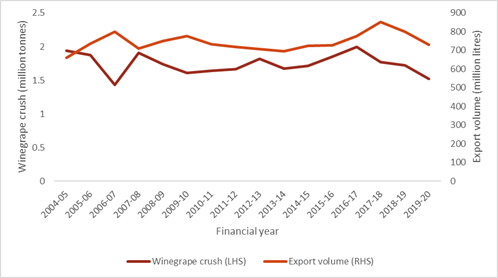

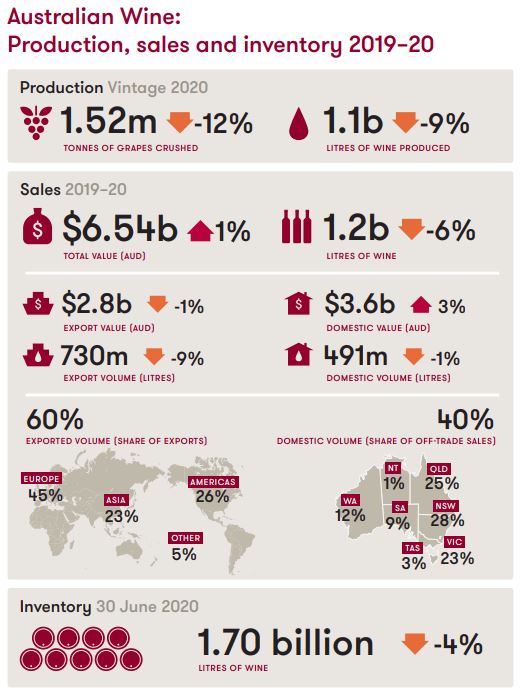

Total Australian wine production in 2019–20 was just under 1.1 billion litres, or 121 million 9-litre case equivalents. This was 9 per cent below the previous year’s production, and 10% below the 10-year average.

The inventory of Australian wine, within Australia, as at 30 June 2020 is estimated to be 1.7 billion litres, a decline of 4% compared with the previous year.

Wine Australia chief executive officer Andreas Clark said that this was not unexpected, as the 2020 crush was the lowest since 2007 at 1.52 million tonnes.

“While quality was generally high in 2020, it was a challenging vintage, with drought conditions affecting much of Australia and bushfires affecting a small number of wine regions,” Mr Clark said.

The total volume of Australian wine sales in 2019–20 was just over 1.2 billion litres (136 million 9-litre cases), of which 40% was sold on the domestic market and 60% was exported. Domestic sales were down by 1% , while exports were down 9%.

Mr Clark said that the small decline in sales to the domestic market was consistent with long-term trends of moderation and premiumisation in mature wine markets, while the decline in exports was in line with lower Australian vintages in 2018 and 2019. He noted that COVID-19 had not appeared to have had a substantial impact on overall sales volumes during the period covered by the report.

Mr Clark said the report period preceded the imposition of interim tariffs on bottled wine exports to China that were introduced in November 2020, with a significant impact on exports to that market.

“COVID-19 only began to make its presence felt in most countries during the fourth quarter of 2019–20, and while it caused major disruptions to sales channels, overall consumption seems to have been relatively unaffected,” Mr Clark said.

Despite sales decreasing overall by 6% compared with 2018–19, sales still exceeded the volume of wine and other grape products produced by over 60 million litres.

As a result, Wine Australia estimates that stocks of Australian wine and other grape products have fallen by approximately 70 million litres (4%) to 1.7 billion litres, the lowest since 2011–12.

“The past three years have seen growth in demand and falling production, leading to reduced volumes available for export and declining stocks,” Mr Clark said.

“This period of under-supply has seen winegrape and wine prices strengthen, which is good news for grapegrowers and winemakers.”

The reduction in overall inventory was driven by a decrease of 100 million litres in white wine stocks, partially offset by increases in red, sparkling, fortified and other products. For the past two years, the white share of total sales has exceeded its share of production, causing its stock-to-sales ratio to fall in 2019–20 to its lowest level in 10 years.

“The results of the survey have highlighted a significant challenge for the sector going forward: to balance supply with the demand opportunities,” Mr Clark said.

“This is particularly important as wineries look to divert exports away from China, which predominantly bought our red wine, to other markets such as the US and the UK, which have a higher demand for white wine.”

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!