For the first time ever, Italy has more listings on UK wine lists than France. That’s according to new research just released by Wine Business Solutions.

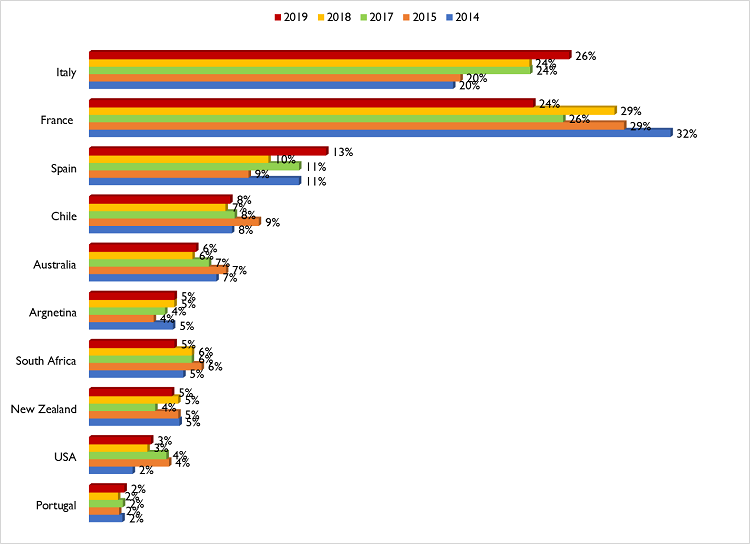

Share of Total Wine Listings by Country – 2014 to 2019

Wine Business Solutions’ Principal, Peter McAtamney says – “This follows the trend that we have been seeing in the US, Canada and Australia, only in those markets, the change has been much more dramatic. Italy has been growing even more strongly whilst France holds its position.

In the UK, the change in market leadership is also due to a lot of high-end French wine being delisted. The boom in Burgundy prices, particularly, came at the wrong time as far as the UK On-Trade was concerned.

Why is Italy having so much success? Value for money is not unimportant. Many of the top French appellations are now so expensive that they no longer fit with what UK restauranteurs know they can sell a bottle of wine for. Also, there would seem to be no place any more on restaurant wine lists in mature markets for ‘show off wine’.

It is tempting to think that this must be all about prosecco, pinot grigio and rose. But it is not. That was 10 years ago. All regions of Italy (and what part of Italy is not a wine region?) can be found on wine lists the world over. It’s all about the depth and sophistication of the Italian offer. There’s a real sense of discovery where the more ‘indigenous’ varieties are concerned.

Ultimately, it is the styles of the wines that wins. They are what restaurants and their customers want. Textural, interesting white wines with lower sulphur levels. Italian white wines have improved, out of sight, during the last 5 years. Savoury, elegant, medium-weight red wine has been a speciality for most Italian regions for many years. These have continued to improve at the same time as they have become better known.

Many of the same things can be said about Spain’s wine offer. Spain, for as long as we have been measuring it, has oscillated wildly in terms of it fashionability in the UK. This, however, has been Spain’s best year ever by some way and, they would surely hope, may represent the breaking of that cycle. Spain is also having the same sort of success as Italy in Canada, the US and, to a lesser extent, Australia.

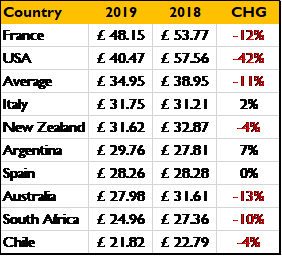

Chile and Australia have had a small reprieve in terms for their share of UK listings (both up 3%) as a result of people under financial pressure seeking out familiar (supermarket) brands. This, however, has driven the average price down for both countries putting them in the worst position. When the market recovers and returns to quality, they will be the worst affected. France will be first to bounce back, based on more than 10 years of measuring these markets.

Argentina, despite all of its internal political and economic woes, has successfully pushed prices higher, setting the country up well, in terms of maintaining image, as the focus moves away from Malbec and towards ‘Mediterranean Reds’.

It’s been an issue for South Africa (down 17% in terms of their listings) that, whilst last year the spotlight was on them, Spain and Italy have very much taken that up this year.

New Zealand’s listings were also down (by 7%) mainly due to Sauvignon Blanc as a category losing out to Italian white varietals. Chardonnay faired much worse (down over 20%).

US average prices are well down but there is still good demand at high prices for Napa and Sonoma Cabernet.”

Average Listed Price of a Bottle of Wine on a UK Wine List in 2019 vs 2018

For more information or to purchase the report, click here, or for more information contact: [email protected]