As the hospitality and liquor trade are starting to see a glimmer of hope about a world learning to co-exist with COVID-19, the industry needs to start thinking about its phoenix strategy.

The direct impact of COVID on the profitability and sustainability of the industry has been discussed. Yet, the challenges of re-opening have yet to be fully considered.

In 2021, both NSW and VIC went into lockdown in the quietest time of the year: winter. According to eBev’s six-year historical trade data, June is an 80% month (100% being average across the year).

However, 2021 June was sitting at just 60% across both the on and off premise. Both states expect to come out of lockdown at the busiest time of year, November/December (140% and 180% months), in addition to the expected pent-up demand from a socially-starved populace.

This could become the perfect storm, generating an immensely difficult capital crunch for an industry already struggling to survive.

Venues without stock and cash flow need to fill their cellars. Suppliers with little or no income for 45 days or longer, with a reduced confidence that venues will be able to pay, yet wanting to supply their venues with more stock, all generate a squeezing of the market and working capital, just when its ready to finally, and thankfully explode.

For the on-premise trade, the first three months of re-opening unfortunately look daunting:

- Most venues will have some cash flow issues, which will mean little money to restock in addition to backdated bills

- Additional venue reopening costs, cleaning of soft and beer lines, venue cleaning, limited staff resources all add additional cash flow burden

- Suppliers held stock will likely go quickly, but will then have to pay for more stock to supply venues before the cash arrives from the initial reopening orders

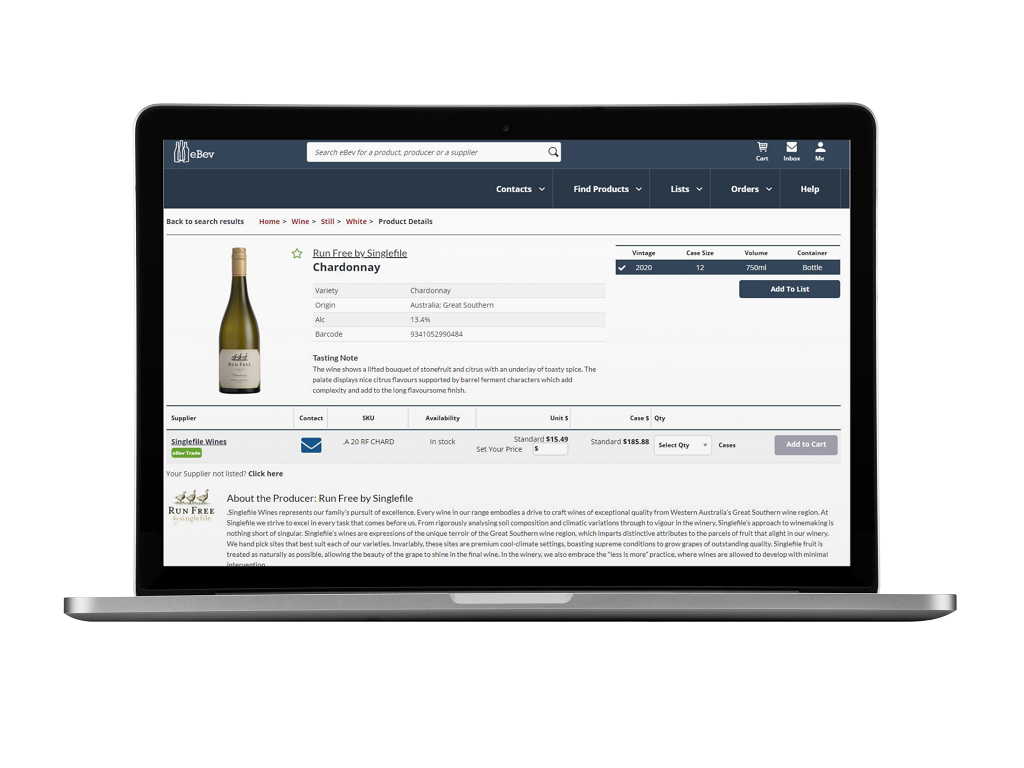

Founded in 2015, eBev has facilitated over 90,000 orders through the platform and enables over $150 million of annual orders.

The new eBev Trade service guarantees payment to suppliers within three days and aims to reduce credit risk whilst enabling beverage businesses to grow as beverage ordering, invoicing, and payments are consolidated into the platform.

Considering the potential capital crunch the industry faces, this financing may be the lifeline that many businesses need to get going again.

Ian Harris, CEO of eBev, said, “The huge hit by COVID to the On-Premise beverage market on both the venue and supplier side cannot be understated”.

“eBev Trade will assist businesses to get back on their feet quicker with improved cash flow and limited risk in selling to venues that are themselves struggling to get back to normal trading. Our platform offers tangible benefits to both sides of the beverage community.

“eBev looks to strengthen the Supplier/Venue relationship with all ordering, invoicing, financed payment options and data entry reduction through accounting and beverage systems integration. The platform aims to make business easier for both sides.”

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!