Exports of Australian wine to mainland China fell 14 percent in value and 29% in volume during 2020 following the imposition of temporary tariffs in November, Wine Australia’s latest export report has revealed.

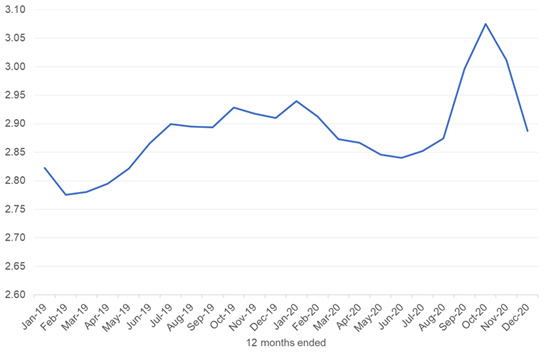

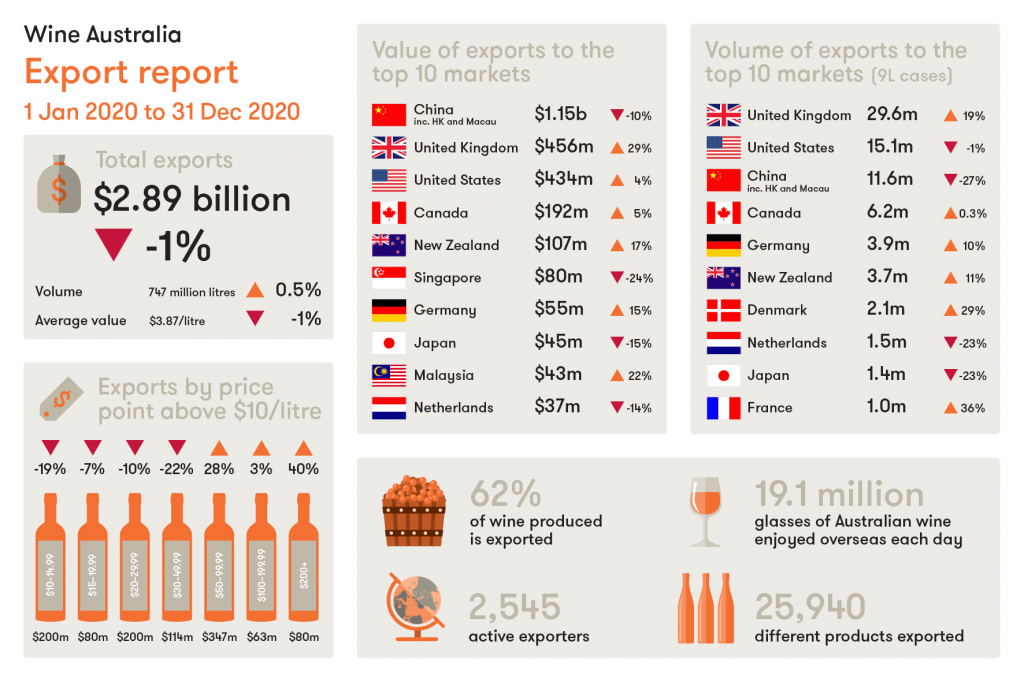

Overall, Australian wine exports slowed in the 12 months to December 2020, decreasing by 1% in value to $2.89 billion, as Chinese tariffs* took their toll on exports to that market, according to the report.

There was a 0.5% increase in volume to 747 million litres (83 million 9-litre case equivalents) and a 1% decline in average price to $3.87 per litre free on board (FOB).

Wine Australia chief executive officer Andreas Clark said that despite the COVID-19 pandemic, exports hit a record year-on-year value of $3.1 billion in the 12 months ended October 2020, before recording a steep decline in the final two months of the calendar year. The previous year-on-year high point had been $3 billion reached in 2007.

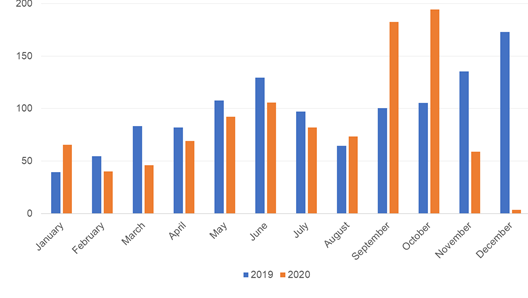

Clark said that there had been a sharp increase in exports from August to October, primarily to mainland China and the United Kingdom (UK), while the decline in November and December was predominantly in exports to China.

Clark said that exports to mainland China were, unsurprisingly, immediately down following the imposition of the temporary tariffs** in November.

The sharp decline in export volumes and value in the final two months of the year (see figure 2) saw the overall value for 2020 decline by 14% to $1.01 billion and volume drop by 29% to 96 million litres (10.7 million 9-litre case equivalents).

It was expected that exports to China would remain low in coming months affecting total export numbers during 2021.

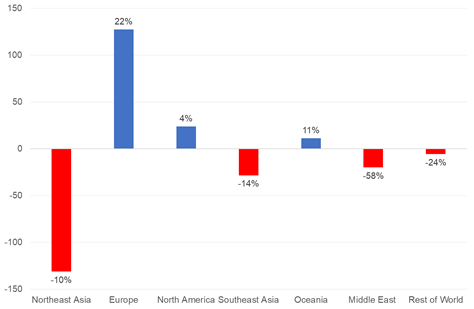

Clark said the decline in exports to China had been offset by significant growth in exports to Europe, up 22% to $704 million – the highest value in a decade. There was also growth in North America, up 4% to $628 million, and Oceania, up 11% to $115 million.

“Wine businesses are resilient and are already adapting to these changed market conditions, increasing their engagement in markets other than China, particularly the UK, US, Canada and the domestic market,” Clark said.

Clark said there was a decline in value across most price points with the notable exception of exports under $2.50 per litre FOB, which grew by 17%, driven by increased shipments to the UK, New Zealand, Scandinavia, Germany and Canada.

Packaged and unpackaged exports

In the year to December 2020, the value of wine exported in glass bottles (the subject of temporary tariffs imposed by China in November 2020) decreased by 5% to $2.3 billion while volume decreased by 9% to 311 million litres (35 million 9-litre case equivalents).

Unpackaged wine exports increased by 20% in value to $585 million and increased 9% in volume to 428 million litres (48 million 9-litre case equivalents). The average price of unpackaged wine increased by 10% to $1.37 per litre FOB.

Destinations:

The top five markets by value:

- Mainland China: down 14% to $1.01 billion.

- United Kingdom (UK): up 29% to $456 million.

- United States of America (US): up 4% to $434 million.

- Canada: up 5% to $192 million.

- Hong Kong: up 27% to $132 million.

The top five destinations by volume:

- UK: up 19% to 266 million litres.

- US: down 1% to 136 million litres.

- Mainland China: down 29% to 96 million litres.

- Canada: up 0.3% to 56 million litres.

- Germany: up 10% to 35 million litres.

United Kingdom

The UK continued the strong growth that commenced at the advent of the pandemic due to increased demand, which was then boosted in the months leading up to Brexit.

Exports in the 12 months ended December 2020 to the UK increased by 29% in value to $456 million and 19% in volume to 266 million litres (29.6 million cases), extending the UK’s lead as the biggest destination for Australian wine exports by volume.

The average price received for Australian wine increased by 9% to $1.71 per litre FOB, the highest level since September 2011.

United States of America

After declining for the three previous calendar years, the value of exports to the US increased, despite the widespread effects of the pandemic and the political turmoil that engulfed the country during the year.

The value of exports increased by 4% to $434 million, despite volume falling by 1% to 136 million litres (15.1 million cases). The average value increased by 5% to $3.21 per litre FOB, the highest level since 2009.

* **The Chinese Ministry of Commerce (MOFCOM) announced a decision to impose temporary deposit tariffs from 28 November 2020 of between 107.1% and 212.1% on Australian wine in containers of up to 2 litres, ahead of finalising its anti-dumping investigation into Australian wine.

MOFCOM then announced an additional temporary countervailing duty deposit from 11 December 2020 of between 6.3% and 6.4% on Australian wine ahead of finalising its countervailing duties investigation.

Definitions:

- MAT is the Moving Annual Total of exports and refers to the 12 months ending with the nominated month.

- FOB is the ‘free on board’ value of the wine, where the point of valuation is where the goods are placed on board the international carrier, at the border of the exporting country. The FOB value includes production and other costs up until placement on the international carrier but excludes international insurance and transport costs.

- All values are expressed in Australian dollars unless specified otherwise.

Are you a Daily Wine News subscriber? If not, click here to join our mailing list. It’s free!